Reporting cpe for 2023 - 2024

Beginning with the 2023 - 2024 reporting period, Utah CPAs will now submit their hours through the new record-keeping system, operated and managed by NASBA through the CPE Audit Service team. This video was recorded from a webinar where Utah CPAs learned how the new system works - go here for a PDF that shows how to enter hours. Below are answers to some of our most frequently asked questions:

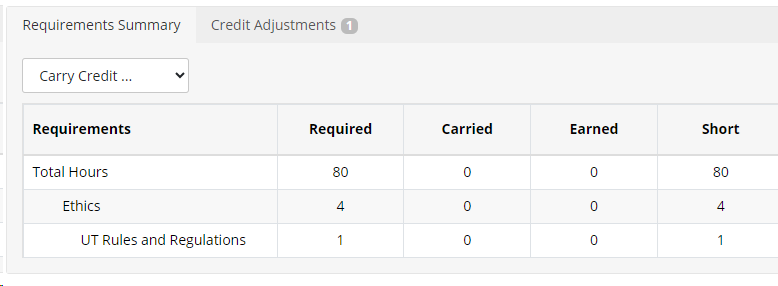

In the Utah Requirements summary, the "UT Rules and Regulations" requirement is listed separately underneath the Ethics requirement. When fulfilled, its credit is also applied to the Ethics and Total Hours requirements.

This display works the same way across the system - with Total Hours requirements at the top and any other requirements nested underneath. (See image below)

Reporting is handled through cpeauditservice.nasba.org

You can get your registration code by emailing B6@utah.gov or the CPE Audit Service team at cpeauditservice@nasba.org. Be sure to provide your Utah license number in your request.

No. However, if you have carryover hours, you will need to create an entry to indicate those hours. For example: Enter a course for 2023-2024 titled 4 carryover credits from 2021-2022.

You have two options:

- Select the reporting period for Jan. 1, 2021 - Dec. 31, 2022 and manually enter your CPE records. If you were diligent in entering those courses in DOPL's old system, you should be able to access that period and they may provide you with screenshots of your entries. Keep in mind, that it will not have any carryover hours that may have been brought into that period, as this was one of the areas that failed to calculate correctly.

- If you do not want to enter in the credit details for the 2021 - 2022 reporting period for the carryover hours, there is a one-time allowance - for the 2023- 2024 period only - to allow you to create a generic manual entry in your account with CPE Audit Service to represent carried forward hours. With minimal information, you can manually create a new "provided" for up to 40 carryover hours. You will need to identify those hours as carryover hours and that they were obtained during the 2021-2022 reporting period.

There is a drop down menu where you can select regulatory ethics and enter your hours for Ethics and Utah Laws & Rules.

The 1 hour of Utah Laws and Rules is included in the 4 hour ethics total, but is listed separately for clarity

when under audit. When you indicate that your course with Regulatory Ethics or Behavioral Ethics contains

the 1-hour of Utah Laws and Rules content, credit will be applied to both the Utah Laws and Rules

requirement as well as the ethics requirement.

In the Utah Requirements summary, the "UT Rules and Regulations" requirement is listed separately underneath the Ethics requirement. When fulfilled, its credit is also applied to the Ethics and Total Hours requirements.

See Example Above

Note: For any course containing either Behavioral Ethics or Regulatory Ethics, a question is presented asking if the course contained one hour of education on Utah's Rules and Regulations. When this question is answered "yes", 1 credit from Behavioral or Regulatory Ethics is applied to the Utah Rules and Regulations requirement. The remainder of ethics credits from that course are applied to the Ethics requirement. When this question is answered "no", then all ethics credits from the course apply only to the Ethics requirement.

If entering a 3-hour ethics course that did not contain the 1-hour of Utah Rules and Regulations, then you will answer the question "no" so that all 3 hours apply to the ethics requirement. Similarly, if entering a 4-hour ethics course that contains 3 hours of ethics and 1 hour of Utah Rules and Regulations, then you will answer the question "yes" so that 1 hour applies to Utah Rules and Regulations and 3 hours applies to the Ethics requirement.

Because Utah is not a NASBA state, you can just enter an "E" for "Exempt."

On the CPE Audit Service website, there is a "help" tab at the top of the page once you have logged in.

If you have questions about entering in ethics courses or any other questions about using the CPE Audit Service, contact CPE Audit Service at cpeauditservice@nasba.org or call number at (844) 273-8722 and leave a voice mail.